The Office of the Tax Ombud is led by the Tax Ombud who is supported by the Chief Executive Officer. The Office currently consists of four business units: Operations, Communications and Stakeholder Relations, Legal Services and Systemic Investigations, and Office Enablement and Support Services. These business units include Operations, Communications and Stakeholder Relations, Legal Services and Systemic Investigations, and Office Enablement and Support Services.

Office of the CEO

The Office of the CEO provides overall strategic leadership and support within the organisation. This includes direction on the development and implementation of organisational strategies, monitoring and evaluation of organisational performance, and governance. The following business units reports to the Office of the Chief Executive Officer:

• Operations

• Legal Services and Systemic Investigations

• Communications and Stakeholder Relations

• Office Enablement and Support Services

Operations

The Operations unit is the core business of the OTO and consists of the Contact Centre and Complaints Resolution. It is responsible for receiving, processing, and addressing queries, and the whole taxpayer complaints resolution process, which includes investigating complaints, sending recommendations to SARS on how a complaint should be resolved and finalising complaints lodged with the OTO.

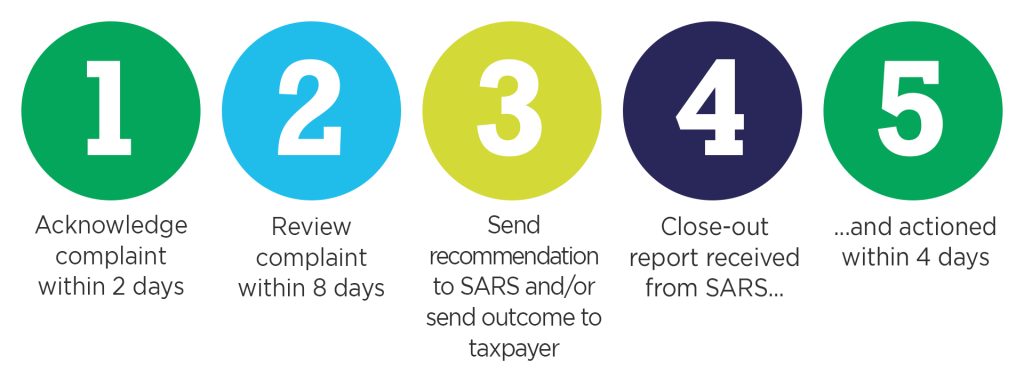

The complaints resolution process promotes efficient resolution of complaints received. The below diagram depicts the complaints resolution process.

Communications and Stakeholder Relations

This unit manages the Communications and Stakeholder Relations of the OTO and is guided by three frameworks; community outreach, digital communications, and stakeholder engagement. These frameworks serve as reference documents for all the OTO’s internal and external communications, public relations activities, reputation management, social media and digital communications, brand management and positioning, stakeholder engagements, language management, and publications. Overall, the unit is responsible for communicating, co-ordinating and implementing taxpayer education and employee communications. The unit is headed by the Senior Manager: Communications and Stakeholder Relations.

Legal Services and Systemic Investigations

The aim of Legal and Systemic Investigations is to provide an enterprise–wide legal service to all business areas of the OTO, inclusive of legal guidance on concluded cases. Legal Services actively participate in the committees and day-to-day business operations to assist with any technical advice relating to complaints or on any corporate legal matters that may arise. Legal specialists and systemic investigators also assist on complaints resolutions by dealing with complex cases.

It is also responsible for attending to systemic issues, including analysing suspected systemic issues, sending recommendations to SARS on how identified systemic issues should be resolved, and compiling systemic investigation reports. Through systemic investigations, the Office identifies areas of improvement in the tax administration system that could enhance taxpayer trust and engagement in the system. In doing so, the Office strives and advocates for fairness, ensuring that the institution remains neutral and objective in reviewing the issues while considering the circumstances of those affected. Read more about systemic issues.

Office Enablement and Support Services

Office Enablement and Support Services provides strategic leadership in coordinating the planning, development and implementation of OTO strategies and policies. The unit also leads and manages Human Resources, Administration and Finance, Strategic Planning, Governance, Risk management and Information Management & Technology.

In addition, the unit aims to continuously improve service delivery and offer innovative ways to improve taxpayer experience. The Unit is headed by a Senior Manager: Office Enablement and Support Services.